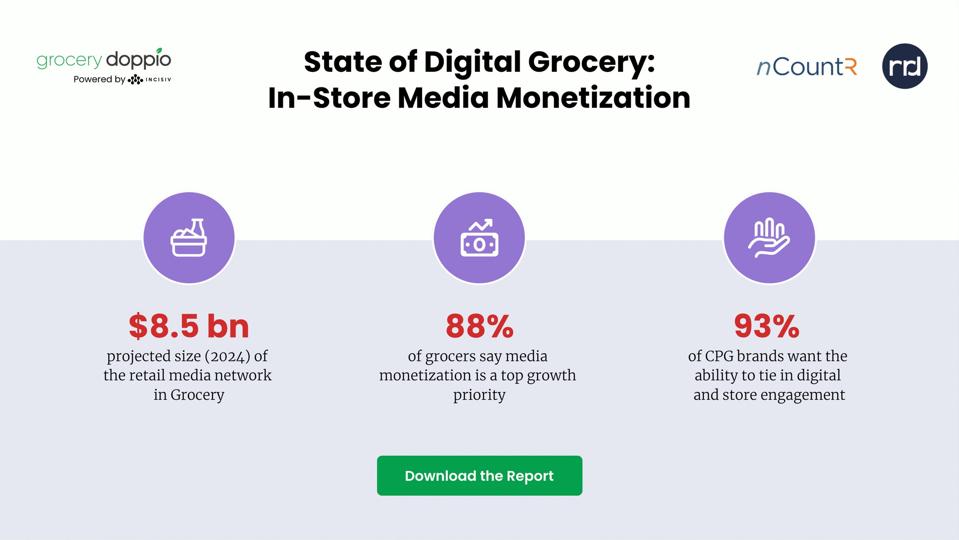

Retail media represents an $8.5 billion opportunity for U.S. grocery retailers in 2024, and executives are moving decisively to capture their share. According to research released last week from Grocery Doppio, 97% of grocers plan to deploy white-label or third-party solutions to deploy a retail media platform. Compared to the expense and time required to build an in-house capability, this approach acknowledges both the urgency and complexity of building competitive retail media capabilities.

Across the grocery category, there’s a wide breadth of adoption and capability around retail media. While as a category, pureplay grocery has generally lagged behind in technology investments, including retail media adoption, this category offers some of the best insights into household demographics and buying behaviors. But there are outliers. Kroger Precision Marketing was built off the back of the company’s impressive data analytics division, and was ranked as the best retail media network for audience targeting and measurement capabilities in the 2023 Path to Purchase Institute survey. (Read my interview with the Senior Vice President of Kroger Precision Marketing.)

Recognizing the significant margin-bolstering potential of retail media, grocery retailers are increasingly integrating advanced technology and retail media to stay competitive. Innovations such as connected digital screens, smart carts, and loyalty-driven data analytics will enable grocers to offer highly personalized shopper experiences and targeted advertising.

Here’s what retailers in this category need to be considering as they build out their retail media offering.

The Retail Media Network (RMN) market will be $8.5 billion Grocery Retailers in 2024, according to … [+]

A Push For Transparency And Control

Major advertisers are setting clear expectations for retail media networks. At recent industry events, PepsiCo’s leadership emphasized that retail media must deliver clear, quantifiable returns across each stage of the sales funnel.

At the industry event GroceryShop, Ram Krishnan, PepsiCo’s CEO of North America beverages, emphasized that retail media must deliver clear, quantifiable returns across each stage of the sales funnel.

This includes rigorous measurement capabilities, precise audience targeting, and flexible creative options. Importantly, PepsiCo requires API access for integration with their in-house analytics, highlighting how sophisticated advertisers expect retail media to operate with the same transparency as established platforms like Meta or Google.

Outside of the grocery category, the Home Depot’s launch this month of ‘Orange Access’, its new self-service retail media platform, exemplifies this evolution toward transparency and control. The retailer partnered with technology providers to create a self-service platform that allows advertisers to independently plan, activate, and optimize campaigns — as opposed to its earlier model requiring media buying to be routed through its in-house team. This approach acknowledges that as retail media spending becomes material, advertisers expect campaigns to align with their business outcomes rather than simply serving retailers’ revenue goals.

Meeting Amazon-Level Expectations

Recent research in the Journal of Marketing Analytics demonstrates why sophisticated capabilities matter. In a study of 122,000 brands on Amazon, researchers found that different advertising products drive different brand metrics – from awareness to consideration to revenue – and their effectiveness varies significantly by brand size and category. Upper-funnel advertising products proved especially effective for small brands, while medium-sized and large brands benefited most from lower-funnel advertising. Outside of the actual advertising products themselves, the study found a strong performance correlation with non-advertising factors such as product descriptions and images, product reviews, and price discounting — capabilities that brand advertisers now expect at a minimum from retail partners.

This complexity creates high expectations for retailers entering the world of retail media. Brands now expect granular targeting, multiple ad formats, and detailed attribution, and other ‘retail readiness’ capabilities as self-serve capabilties from day one.

In-Store Innovation As A Differentiator

While digital retail media capabilities are table stakes, in-store advertising represents a unique opportunity for grocers. Recent research from GroceryTV and Media Ads + Commerce demonstrates its effectiveness, with their meta-study of 16 CPG campaigns showing consistent sales lifts averaging 14%. Even more encouraging, shoppers are remarkably receptive to these messages – 87% report a neutral to positive ad experience with in-store advertising, significantly outperforming other channels like Connected TV at 59%.

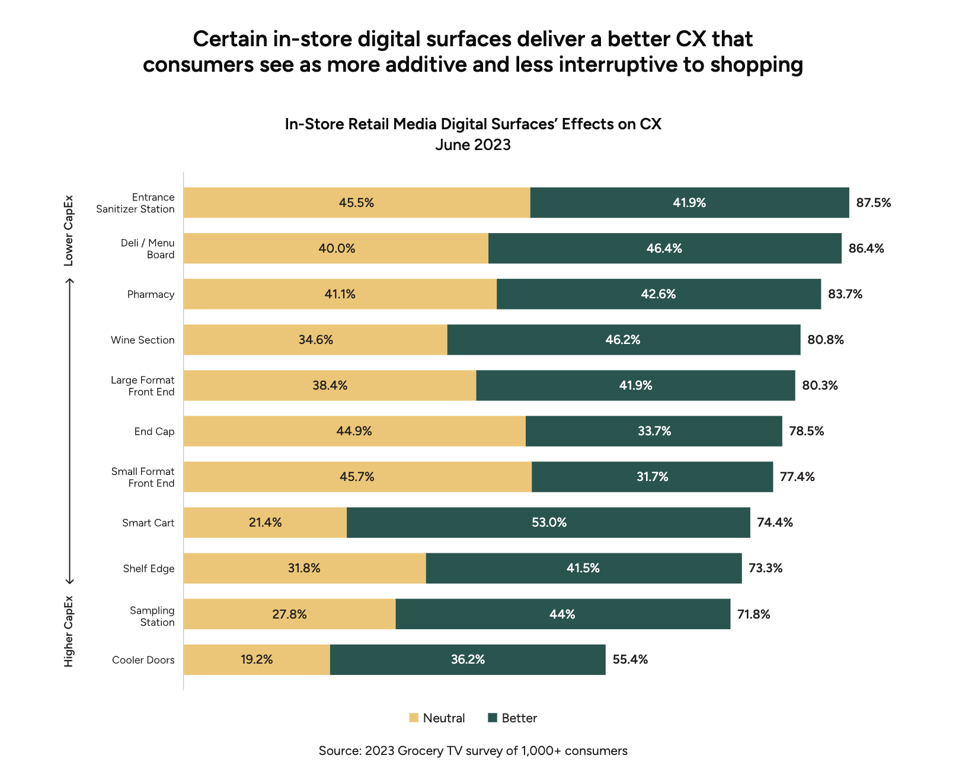

Not all in-store touchpoints are created equal, however. Digital displays at store entrances (87.5% positive/neutral response) and deli/menu boards (86.4%) deliver particularly strong customer experiences. This suggests retailers should prioritize these lower-risk, high-impact touchpoints as they build their networks.

Certain in-store digital surfaces deliver a better CX that consumers see as more additive and less … [+]

The importance of connecting digital and physical channels is clear. According to Grocery Doppio, 93% of CPG brands want the ability to integrate digital and store engagement data for a complete view of the shopper journey. This holistic view helps inform their decisions on ad spend and enables true omnichannel campaign optimization.

Looking Ahead

The retail media opportunity for the grocery category is substantial, but success requires sophisticated targeting and measurement capabilities from day one. The widespread adoption of third-party solutions suggests retailers understand this reality. The key will be selecting and implementing technology partners that can deliver both the digital capabilities brands expect and the ability to bridge online and in-store experiences effectively.

As more technology providers enter the space, retailers have increasing options for building their capabilities. The challenge will be choosing partners that can meet both current advertiser demands and future innovation needs across all channels – digital and physical.